The wealth management industry is experiencing a fundamental shift in how AML compliance operates. Traditional paper-based processes that once dominated client onboarding and ongoing monitoring are giving way to intelligent, data-driven systems that deliver results in minutes rather than weeks.

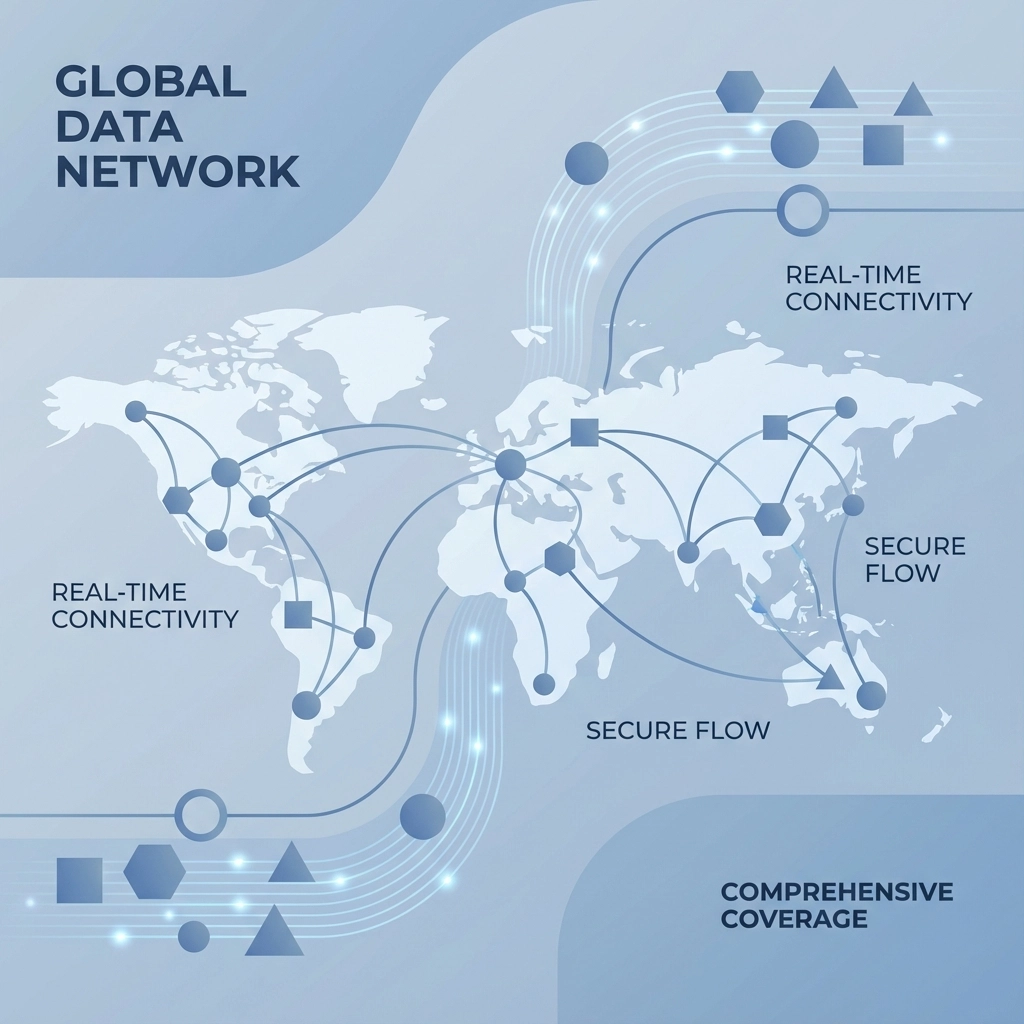

Wealth managers operating under the UK's increasingly stringent regulatory framework now have access to global data feeds that eliminate manual documentation gathering, reduce client friction, and provide comprehensive risk assessment capabilities that surpass anything achievable through traditional methods.

The New Reality of Wealth Management AML

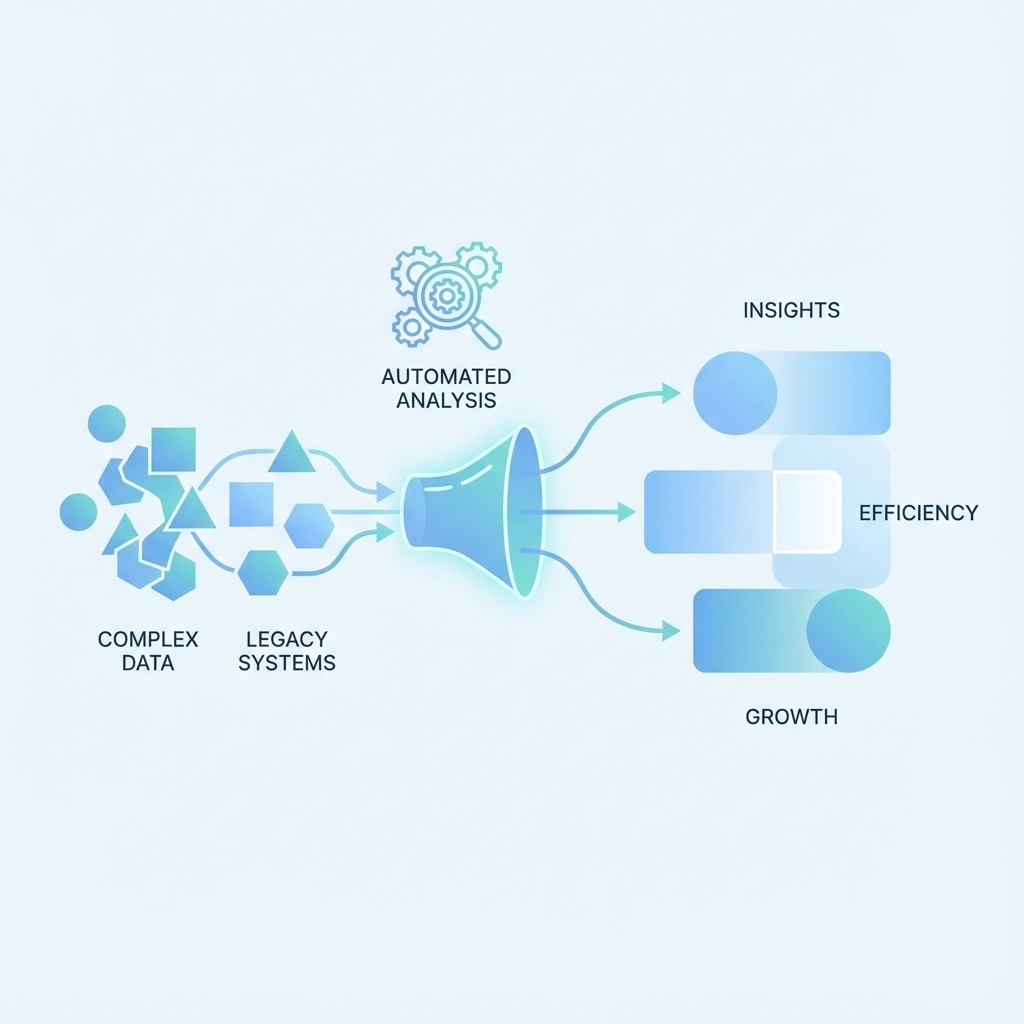

Modern wealth management firms face complex compliance challenges that manual processes simply cannot address effectively. High-net-worth clients operate across multiple jurisdictions, maintain intricate corporate structures, and expect seamless service delivery that traditional AML processes actively undermines.

The regulatory landscape compounds these challenges. The FCA's data-driven supervisory approach means compliance teams need audit trails that demonstrate comprehensive due diligence across all client touchpoints. Meanwhile, proposed Economic Crime Bill provisions would make failure to prevent money laundering a criminal corporate offense, creating direct liability for firms that miss suspicious activity.

Global data feeds transform this equation entirely. Instead of requesting documents, verifying authenticity, and manually cross-referencing against watchlists, wealth managers can now access real-time intelligence from comprehensive databases that provide instant verification and ongoing monitoring capabilities.

How Global Data Feeds Eliminate Manual Processes

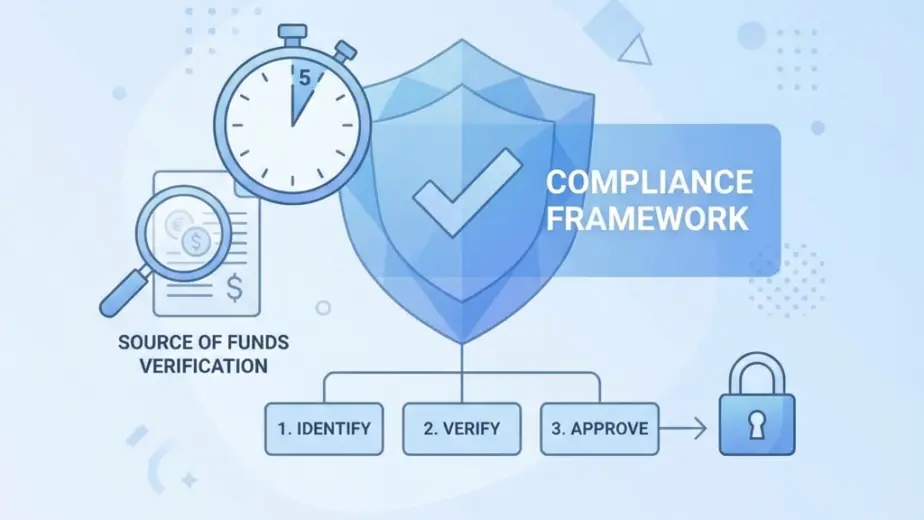

Automated identity verification processes extract and validate client information from uploaded documents within seconds, cross-referencing details against global sanctions lists, PEP databases, and adverse media feeds simultaneously. This approach delivers consistent results regardless of client volume or complexity.

Real-time sanctions screening operates continuously rather than as point-in-time checks. Every client interaction triggers fresh searches against updated watchlists, ensuring compliance teams receive immediate alerts when risk profiles change. The system maintains complete audit trails of every search, decision, and alert for transparent regulatory reporting.

Enhanced Due Diligence (EDD) processes that previously required weeks of manual research now complete automatically. Advanced EDD capabilities access global corporate registries, beneficial ownership databases, and litigation records to build comprehensive risk profiles without manual intervention.

Source of Funds verification transforms from document-heavy processes into streamlined data analysis. Modern platforms access banking data, investment records, and income verification sources to validate wealth origins while maintaining client privacy and reducing documentation requirements.

The Data Advantage: Scale Meets Accuracy

Comprehensive global coverage makes the difference between effective and superficial AML compliance. Leading platforms now access over 4.8 million profiles and 30,000+ data sources worldwide, updated monthly to ensure current information drives every compliance decision.

This data depth enables wealth managers to verify complex ownership structures, trace beneficial ownership across multiple jurisdictions, and identify connections that manual processes would miss entirely. Family offices, trust structures, and offshore entities become transparent rather than compliance obstacles.

Continuous monitoring capabilities leverage this extensive data coverage to provide ongoing risk assessment. Machine learning algorithms analyze transaction patterns, relationship networks, and behavioral indicators to identify unusual activity that rule-based systems cannot detect.

The monthly update cycle ensures compliance teams work with current information. Sanctions lists, PEP designations, and adverse media coverage change constantly: automated systems ensure these updates immediately reflect in all client risk assessments.

Transforming Client Experience While Strengthening Compliance

Data-driven AML processes deliver superior client experiences alongside enhanced compliance outcomes. Wealthy clients expect immediate access to services and minimal documentation requirements: global data feeds make both possible.

Onboarding processes that previously required multiple document submissions and verification rounds now complete through single digital interactions. Clients upload identification documents once, and automated systems handle verification, sanctions screening, and risk assessment simultaneously.

Ongoing monitoring operates invisibly to clients while providing compliance teams with comprehensive oversight. Regular account reviews happen automatically, generating alerts only when genuine risk indicators emerge rather than routine administrative triggers.

Cross-border transactions receive instant screening rather than delayed processing while compliance teams verify counterparties and transaction purposes. This approach maintains transaction flow while ensuring comprehensive oversight of international wealth movement.

Implementation Strategies for Immediate Impact

Successful implementation begins with comprehensive data source integration. Anti-money laundering platforms that access global databases provide immediate coverage across all client types and transaction patterns.

Workflow automation eliminates manual handoffs between systems and departments. Client data flows automatically from initial onboarding through ongoing monitoring, creating seamless processes that reduce errors and accelerate decision-making.

Staff training focuses on interpreting automated insights rather than conducting manual research. Compliance teams learn to analyze risk scores, investigate alerts efficiently, and make informed decisions based on comprehensive data analysis.

Audit trail generation becomes automatic rather than manual compilation. Every screening decision, risk assessment, and monitoring alert creates detailed records that support regulatory examinations and demonstrate comprehensive compliance frameworks.

Measurable Results: Speed, Accuracy, and Cost Reduction

Wealth managers implementing global data feeds report dramatic efficiency improvements. Client onboarding processes that previously required 5-10 business days now complete within hours, while ongoing monitoring operates continuously without manual intervention.

Accuracy improvements prove equally significant. Automated systems eliminate human errors in data entry, sanctions screening, and risk assessment while providing consistent application of compliance standards across all clients.

Cost reductions emerge through reduced manual processing requirements. Compliance teams focus on high-risk cases and complex investigations rather than routine verification tasks, improving resource allocation while strengthening overall compliance effectiveness.

Advanced Capabilities for Complex Wealth Structures

Modern AML platforms address the specific challenges of ultra-high-net-worth compliance. Beneficial ownership mapping tracks complex corporate structures automatically, while relationship analysis identifies connections across multiple accounts and entities.

Trust and foundation analysis capabilities parse complex legal structures to identify ultimate beneficial owners and control mechanisms. This analysis operates across multiple jurisdictions and legal frameworks, providing comprehensive visibility into wealth origins and management structures.

Investment monitoring extends beyond traditional transaction analysis to assess portfolio composition, investment strategies, and risk concentration. These capabilities help identify unusual investment patterns that may indicate money laundering or sanctions evasion attempts.

Regulatory Compliance in a Digital Framework

Digital audit trails generated by automated systems exceed traditional compliance documentation standards. Every client interaction, screening decision, and risk assessment creates detailed records that demonstrate comprehensive due diligence efforts.

Regulatory reporting becomes streamlined through automated data compilation and analysis. Monthly, quarterly, and annual reports generate automatically while ensuring accuracy and completeness that manual processes cannot match.

Examination readiness improves dramatically when compliance teams can demonstrate consistent, comprehensive, and well-documented AML processes. Automated systems provide the evidence base that regulatory examinations require while reducing preparation time and stress.

The Path Forward: Implementation and Success

Wealth managers ready to eliminate paper-based AML processes should begin with comprehensive platform evaluation. Securities and investments compliance solutions that integrate global data feeds provide the foundation for transformed compliance operations.

Phased implementation approaches reduce disruption while ensuring successful adoption. Starting with client onboarding processes allows teams to experience benefits immediately while building confidence for broader system deployment.

Success metrics should focus on processing speed, accuracy improvements, and cost reduction rather than traditional compliance measures alone. These business-focused metrics demonstrate the strategic value of modern AML platforms while ensuring regulatory requirements receive proper attention.

Global data feeds represent the future of wealth management compliance: a future where comprehensive risk assessment, superior client experience, and streamlined operations combine to create competitive advantages that traditional approaches cannot match. The question is not whether to adopt these capabilities, but how quickly implementation can begin.