Smart, simple, and secure AML checks designed for regulated businesses.

Our AML functionality helps you identify and manage financial crime risk by screening customers against a wide range of global data sources. These checks enable you to confirm whether individuals present an elevated risk due to sanctions, political exposure, adverse media, or other regulatory concerns.

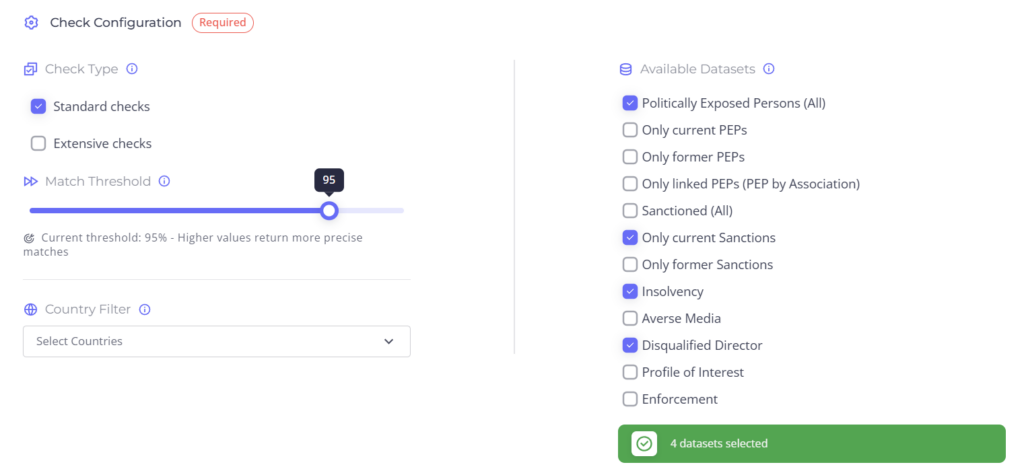

Perform all AML checks in one place, choosing standard or extensive screening as needed.

Sanctions & Watchlist

Regulatory Risk Checks

Perform targeted checks against official sanctions lists and watchlists to determine whether an individual or organisation is subject to regulatory restrictions. This includes identification of sanctioned entities and Politically Exposed Persons (PEPs), enabling you to meet mandatory compliance requirements.

Global Check

Extended Risk Screening

Conduct a broader risk assessment by screening clients against 1,000+ international data sources beyond sanctions lists. These checks surface indicators such as adverse media, insolvency records, enforcement actions, and director disqualifications, providing wider context to support risk-based decision-making.

How we support AML requirements

Sanctions, Adverse Media, PEP & Watchlist Screen

Sanctions screening involves checking individuals or entities against official government or international lists of sanctioned parties. These sanctions can be imposed for various reasons, including terrorism, drug trafficking, human rights violations, or political conflicts. We also check for adverse media across hundreds of high quality news sources, and enforcements or disqualifications.

Possible sanctions checks include:

- Sanctions check, without having to do separate AML - International Sanctions

- Enhanced PEP check, without having to do separate AML - International Enhanced PEP

- Adverse media - over 200 sources

Ongoing Monitoring

Screening customers at the point of account opening or beginning of a business relationship is only the first step. As people and businesses change, being alerted to anything that could impact your risk is critically important.

- Smart Engagement Alerts

Stay ahead with real-time notifications about critical changes in your customer accounts—so you can act quickly and confidently. - Perpetual KYC & KYB Monitoring

Get instant, event-based alerts when key financial or credit information changes for individuals or businesses on your watchlist. Stay compliant, stay informed. - PEP, Sanctions & Adverse Media Screening

Re-screen customers anytime against global databases of PEPs, sanctions, and negative news. Set custom monitoring frequencies based on risk profiles—your compliance, your way. - Daily Engagement Emails

Start your day with a summary of actionable insights—timely updates that give you compelling reasons to reach out to customers and prospects.