Risk and Compliance in the AI Era

Faster onboarding. Fewer false positives. Confident decisions.

This is what a modern compliance platform should be. We unify 30,000+ data sources for KYC, KYB and AML, using AI to prioritise red flags and minimise manual review—so your credit, risk and compliance teams approve clients and suppliers faster, with confidence.

Risk and Compliance in the AI Era

Faster onboarding. Fewer false positives. Confident decisions.

This is what a modern compliance platform should be. We unify 30,000+ data sources for KYC, KYB and AML, using AI to prioritise red flags and minimise manual review—so your credit, risk and compliance teams approve clients and suppliers faster, with confidence.

Decision Intelligence Built for Modern Business

True due diligence requires more than just regulatory tick-boxes. Our platform unifies deep commercial credit data with rigorous compliance screening, delivering the reliable insights your team needs to assess both risk and opportunity. Designed to integrate seamlessly with your existing workflows, it empowers your organization to stay ahead of obligations and grow with confidence.

Rapid

Our AI-supported decisioning runs global checks in seconds, filtering out noise to optimise your onboarding workflow instantly.

Accurate

We cross-reference compliance and credit risk data using advanced reasoning to minimise risk and drastically reduce false positives.

Comprehensive

We leverage access to over 30,000 data sources across 200+ countries, updated continuously to ensure up-to-the-minute global coverage.

Platforms

Access Compliability seamlessly through your preferred platform, including our Web Portal or Salesforce CRM.

Complete Risk and Compliance Coverage

Know Your Customer (KYC)

Streamline your AML compliance process with instant identity verification, PEP and sanction checks, adverse media and more

Know Your Business (KYB)

Identify UBOs and verify entities with comprehensive credit reports and financial risk data, alongside standard PEP and sanction checks.

Source of Funds (Open Banking)

Verify financial origins instantly using secure Open Banking to analyse income, expenditure, and wealth accumulation with forensic accuracy.

Risk & Credit Intelligence

Access detailed company financials, credit scores, and limit recommendations to assess commercial stability alongside compliance risk.

Continuous Monitoring

Stay ahead of risk with daily automated screening of adverse media and global watchlists, alerting you instantly to changes in client status.

Proof of Ownership

Validate ownership of property and key assets via direct registry integrations, ensuring funds and collateral are backed by verified equity.

Intelligent Reasoning, Proven Results

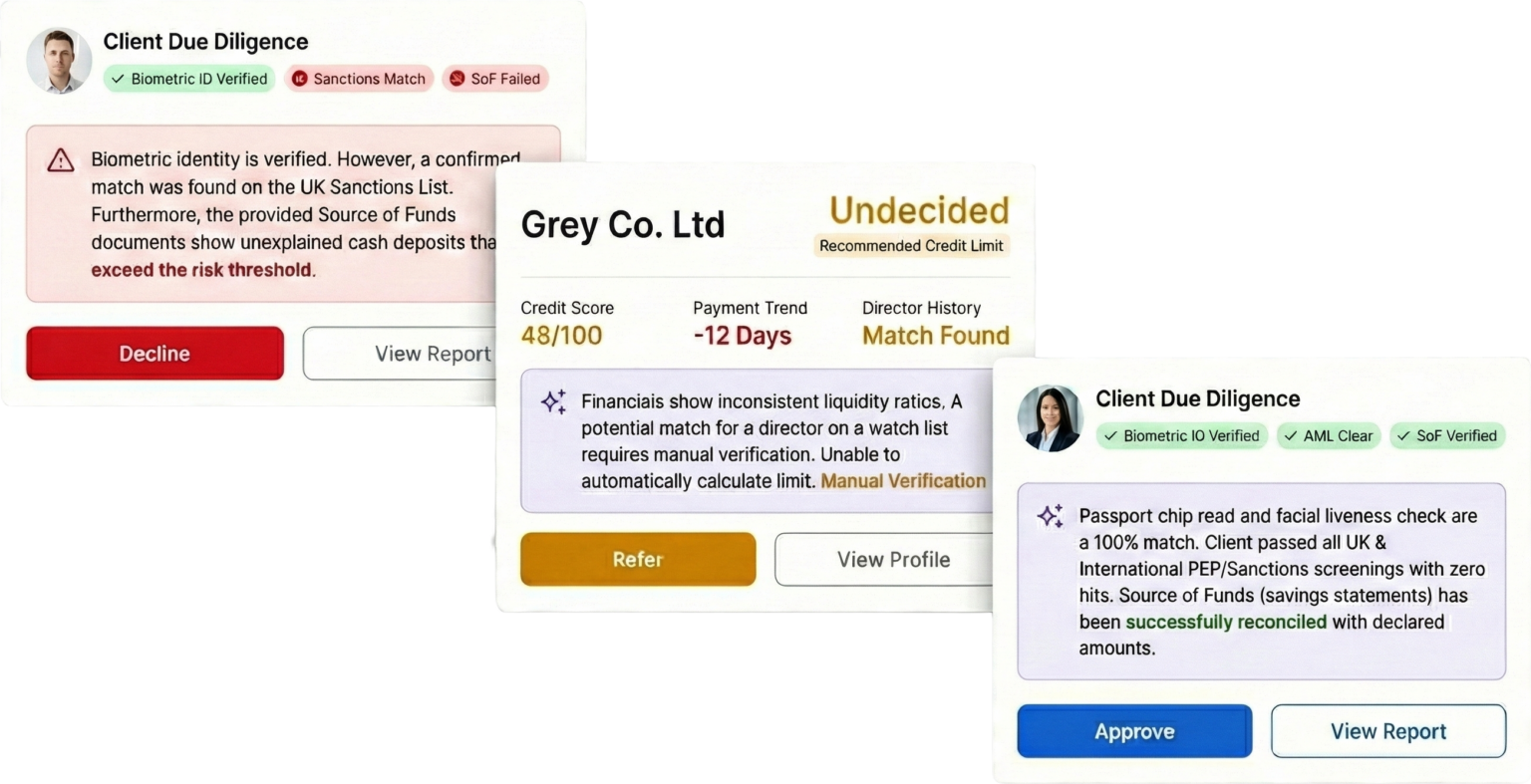

We don’t replace your experts; we give them a digital partner. Compliability moves beyond simple summaries, deploying AI Agents to actively investigate complex report data. Instead of just flagging hits, our Agents reason through the evidence to separate false positives from genuine risks.

Acting as a digital investigator, our platform cross-references documents, disambiguates identities, and drafts decision memos for your review. This resolves the majority of routine checks autonomously, ensuring your human experts focus only on the high-risk entities that truly demand their judgment.

Flexible pricing

Starter Plan

£ 199

-

AML Checks

-

Identity Verification

-

Adverse Media Monitoring

-

Right to Rent/Work

-

Live Chat Support

-

Recommended

Growth Plan

£ 299

-

Everything in Starter

-

Enhanced Due Diligence

-

Enhanced AML

-

AML Monitoring

-

AI Data-driven insights

Custom

You Choose

-

Choose your checks

-

Choose the volumes

-

IDV, KYC, EDD, KYB

-

Right to Rent/Work

-

Total flexibility

Empowering Regulated and Risk-Aware Industries

Make rapid, clear-cut decisions about your partners and clients using a unified view of regulatory and financial risk. Our platform delivers the compliance-grade data you need to satisfy regulators, while providing the commercial insights required to seize new opportunities with confidence.

-

Banking and Financial Services

-

Legal and Accounting Professions

-

Insurance

-

Securities and Investments

-

Estate and Letting Agents

-

Gaming and Gambling

-

Corporate & Enterprise

Frequently asked questions

Compliability is reinventing the way businesses meet their regulatory requirements. Here we answer questions related to AML regulations and Compliability benefits

What sectors need to do AML compliance checks

Anti-Money Laundering (AML) checks are required in a variety of sectors—especially those at high risk of being used for money laundering or terrorist financing. These sectors are typically known as regulated sectors, and the specific obligations can vary slightly by jurisdiction (e.g., EU, UK, US, etc.), but here's a general list of the main sectors that must perform AML checks before onboarding a new client.

Financial Sector

These are the most heavily regulated:

- Banks

- Credit unions

- Payment service providers (e.g., PayPal, Revolut)

- Money service businesses (MSBs) – including currency exchanges, remittance companies

- Lenders and mortgage providers

- Insurance companies – especially life insurance

Investment & Securities Sector

- Brokerages

- Investment firms

- Asset managers and hedge funds

- Crypto exchanges and wallet providers (in many jurisdictions)

Professional Services

These often serve as "gatekeepers" to the financial system:

- Lawyers and notaries – especially those involved in real estate, company formation, or large transactions

- Accountants and auditors

- Tax advisors

Real Estate Sector

- Estate agents / real estate brokers

- Letting agents (in some jurisdictions)

- Developers and other entities involved in large property transactions

High-Value Goods Dealers

Anyone dealing in large cash transactions:

- Luxury goods retailers (cars, jewelry, art, antiques)

- Auction houses

- Precious metals and stones dealers

Gambling and Gaming Sector

- Casinos (including online)

- Betting and gaming operators

- Lotteries (especially private ones)

Trusts and Company Service Providers (TCSPs)

Those who help set up, manage, or operate companies, trusts, or foundations

What checks need to be carried out?

AML (Anti-Money Laundering) checks involve a series of processes designed to detect and prevent money laundering and terrorist financing

Identity Verification (ID&V)

Verify that the customer is who they say they are.

For individuals:

- Government-issued ID (passport, national ID, driver’s license) with biometric matching

- Proof of address (utility bill, bank statement, lease agreement, dated within 3 months)

For businesses:

- Company registration documents (e.g., certificate of incorporation)

- Names and details of directors and Ultimate Beneficial Owners (UBOs)

- Ownership structure chart (for complex entities)

Sanctions, PEPs, and Watchlist or negative media Screening

- Check against global sanctions lists (e.g., OFAC, UN, EU)

- Check if the person is a Politically Exposed Person (PEP) or linked to one (family/associates)

- Screen for inclusion on criminal watchlists or negative media

Source of Funds / Source of Wealth

Mainly for high-risk or high-value customers.

- Source of Funds: Where the money for a specific transaction comes from (e.g., salary, sale of a property)

- Source of Wealth: How the customer acquired their overall wealth (e.g., inheritance, business ownership)

How does Compliability reduce my risk of bad debts?

Our KYB process includes verfiying a business is genuine, then checks its financial health and stabilty, delivering a clear credit rating and limit. With access to company data in over 200 countries, we are able to check the financials of any business for stability and credit worthiness.

How can my team access Compliability?

Compliability can be accessed in 2 ways, via our Web Portal, or directly within Salesforce. Both offer the same feature set and pricing, so choose the option that best suits your business. Our team are always on hand to advise and support.