The compliance landscape in 2026 presents law firms with a clear choice: continue wrestling with time-intensive manual processes or embrace RegTech solutions that deliver measurable efficiency gains. With regulatory requirements expanding across every sector and client expectations reaching new heights, the time savings offered by modern compliance technology have transformed from a nice-to-have into an essential competitive advantage.

The Traditional Compliance Time Drain

Traditional compliance workflows in law firms typically consume 3-5 hours per client onboarding, with senior associates spending significant portions of their billable time on repetitive verification tasks. This approach involves multiple touchpoints: manual database searches, phone calls to third-party verification services, document reviews, and extensive cross-referencing across various platforms.

The process becomes even more complex when handling high-net-worth clients or complex corporate structures. A single enhanced due diligence case can require 8-12 hours of research across multiple jurisdictions, with associates manually checking sanctions lists, PEP databases, and adverse media sources. These time investments directly impact profitability and limit the firm's capacity to take on new clients.

Manual processes also create bottlenecks during peak periods. When multiple clients require compliance checks simultaneously, firms often face a choice between rushing through verification procedures or delaying client onboarding. Neither option serves the firm's long-term interests, particularly when competitors can complete similar processes in minutes rather than hours.

RegTech's Automated Advantage

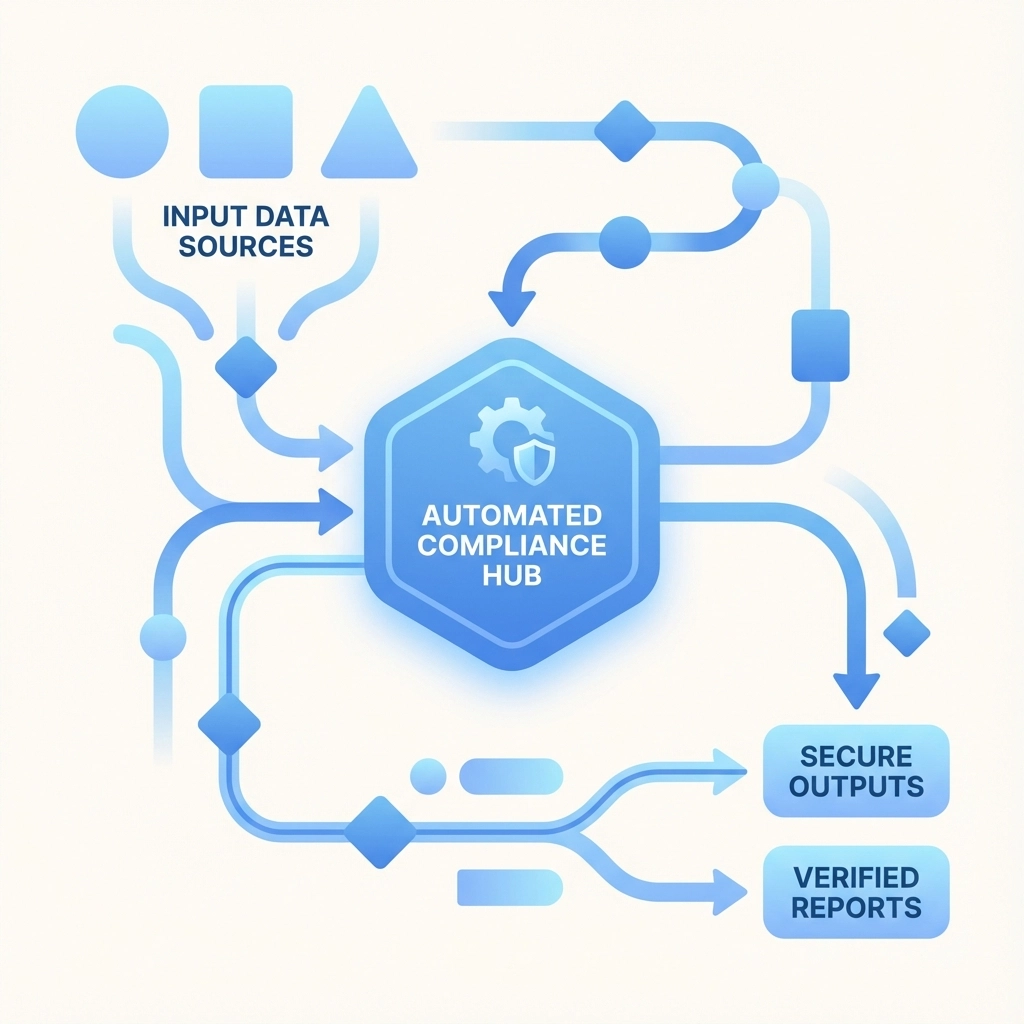

RegTech solutions fundamentally restructure the compliance timeline by automating tasks that traditionally require human intervention. Modern platforms process client verification requests in real-time, accessing comprehensive databases and delivering actionable results within minutes of initiation.

The automation extends beyond simple database queries. Advanced RegTech platforms use artificial intelligence to analyze complex ownership structures, identify beneficial ownership relationships, and flag potential risk indicators without human oversight. This intelligent processing delivers consistent results while freeing legal professionals to focus on interpretation and client advisory services.

Real-time monitoring capabilities represent another significant time advantage. Instead of conducting periodic manual reviews, RegTech solutions continuously monitor client profiles against updated sanctions lists, PEP databases, and adverse media sources. This ongoing surveillance eliminates the need for scheduled re-verification processes while ensuring continuous compliance.

Implementation Speed and Simplicity

Law firms evaluating RegTech solutions often express concern about implementation complexity and training requirements. Modern platforms address these concerns through intuitive interfaces and seamless integration capabilities.

Leading RegTech providers offer plug-and-play solutions that integrate directly with existing case management systems and CRM platforms. The integration process typically requires minimal IT involvement and can be completed within days rather than weeks. This rapid deployment allows firms to realize time savings immediately without extended transition periods.

Training requirements for RegTech platforms are minimal compared to traditional compliance software. Intuitive dashboards and automated workflows enable legal professionals to begin using the technology productively within hours of implementation. The learning curve is gentle, and most firms report full adoption across their teams within the first week of deployment.

Enhanced Client Experience Through Speed

Client expectations in 2026 center around speed and transparency. Modern clients expect law firms to operate with the same efficiency they experience from their financial services providers and other professional service firms. RegTech solutions enable firms to meet these expectations while maintaining rigorous compliance standards.

Instant verification capabilities allow firms to complete client onboarding during initial consultations. This immediate processing creates a positive first impression and demonstrates the firm's technological sophistication. Clients appreciate the streamlined experience and the elimination of follow-up requirements for additional documentation.

The transparency offered by RegTech platforms also enhances client relationships. Real-time compliance dashboards allow firms to provide clients with immediate status updates and clear explanations of verification processes. This transparency builds trust and reduces client anxiety about compliance requirements.

ClearSignal's Comprehensive Data Advantage

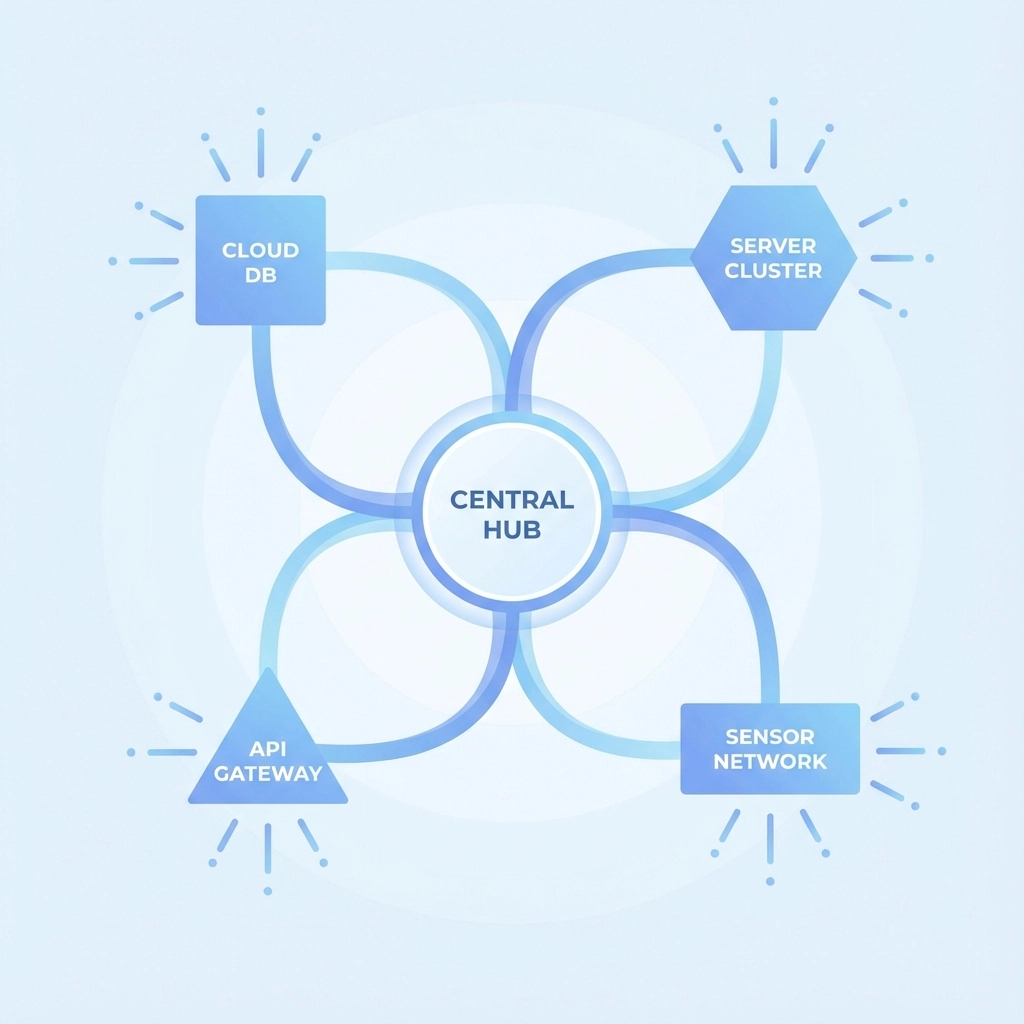

ClearSignal's platform demonstrates the power of comprehensive data access in delivering superior time savings. With instant access to over 4.8 million profiles and 30,000+ data sources, the platform eliminates the manual research that traditionally consumes hours of professional time.

The breadth of data sources ensures comprehensive coverage without requiring multiple platform subscriptions. Legal professionals access global sanctions lists, PEP databases, corporate registries, and adverse media sources through a single interface. This unified access point eliminates the time spent switching between platforms and cross-referencing results from multiple sources.

AI-powered decisioning capabilities within the platform deliver intelligent risk assessments that would require significant manual analysis using traditional methods. The system automatically identifies complex relationships, flags potential risks, and provides clear recommendations for next steps. This intelligent processing delivers consistent results while dramatically reducing the time required for complex compliance evaluations.

Seamless Integration for Immediate Impact

The integration capabilities offered by modern RegTech platforms eliminate implementation barriers that traditionally delayed adoption. ClearSignal's portal solution and Salesforce plugin exemplify this seamless approach, allowing firms to access comprehensive compliance capabilities without disrupting existing workflows.

The portal provides a complete compliance solution accessible from any device, enabling remote verification and flexible working arrangements. Legal professionals can initiate and complete compliance checks from client offices, home offices, or while traveling, maintaining productivity regardless of location.

Salesforce integration brings compliance capabilities directly into the CRM environment where client relationships are managed. This integration eliminates the need to switch between platforms and ensures compliance information remains accessible alongside client communication history and case details.

Measuring Real-World Time Savings

Law firms implementing RegTech solutions consistently report dramatic time savings across compliance workflows. Client onboarding times decrease from hours to minutes, allowing firms to process more clients with existing staff resources. Enhanced due diligence processes that previously required full days of research can be completed in under an hour with comprehensive results.

These time savings translate directly into improved profitability and increased capacity. Firms report ability to take on 30-50% more clients without adding compliance staff. The time previously spent on manual verification processes becomes available for higher-value client advisory services and business development activities.

Ongoing monitoring capabilities deliver additional time savings by eliminating periodic manual reviews. Automated alerts notify legal professionals immediately when client risk profiles change, replacing scheduled review processes with event-driven notifications.

Strategic Positioning for 2026 and Beyond

The compliance landscape in 2026 rewards firms that can deliver speed without compromising thoroughness. RegTech solutions provide the technological foundation for this dual capability, enabling firms to differentiate themselves through superior client service and operational efficiency.

Firms implementing comprehensive RegTech solutions position themselves as forward-thinking organizations that understand modern client expectations. This positioning becomes increasingly important as clients evaluate legal service providers based on technological sophistication alongside traditional legal expertise.

The competitive advantages created by RegTech adoption compound over time. Firms that establish efficient compliance workflows can focus their growth investments on client acquisition and service expansion rather than compliance infrastructure. This strategic advantage becomes more pronounced as regulatory requirements continue expanding across all sectors.

The choice between traditional compliance methods and RegTech solutions represents more than a technology decision: it defines how law firms will operate in 2026 and beyond. RegTech solutions like ClearSignal deliver measurable time savings, seamless implementation, and enhanced client experiences that position firms for sustained competitive success in an increasingly demanding marketplace.