Source of funds verification has evolved from a simple box-ticking exercise to a critical compliance cornerstone that can make or break your firm's regulatory standing. With new HMRC guidance effective since April 2025 and increasingly sophisticated money laundering schemes targeting the legal sector, law firms need a verification framework that delivers both speed and certainty.

The traditional approach to SoF verification: manually reviewing months of bank statements, cross-referencing multiple documents, and conducting lengthy client interviews: no longer meets the demands of modern legal practice. Today's compliance leaders are implementing streamlined frameworks that reduce verification time from hours to minutes while actually improving accuracy and regulatory confidence.

The Modern SoF Verification Challenge

Law firms handle an average of 247 property transactions annually, each requiring comprehensive source of funds verification under the Money Laundering Regulations 2017. The Solicitors Regulation Authority has identified SoF verification as "a fundamental part of the risk-based approach," yet 73% of firms still rely on manual processes that consume 45 minutes per verification on average.

This manual approach creates three critical pressure points: delayed transaction completions, increased operational costs, and heightened regulatory risk. When clients provide incomplete documentation or complex funding structures involving multiple sources, verification times can extend to several days, directly impacting client satisfaction and firm profitability.

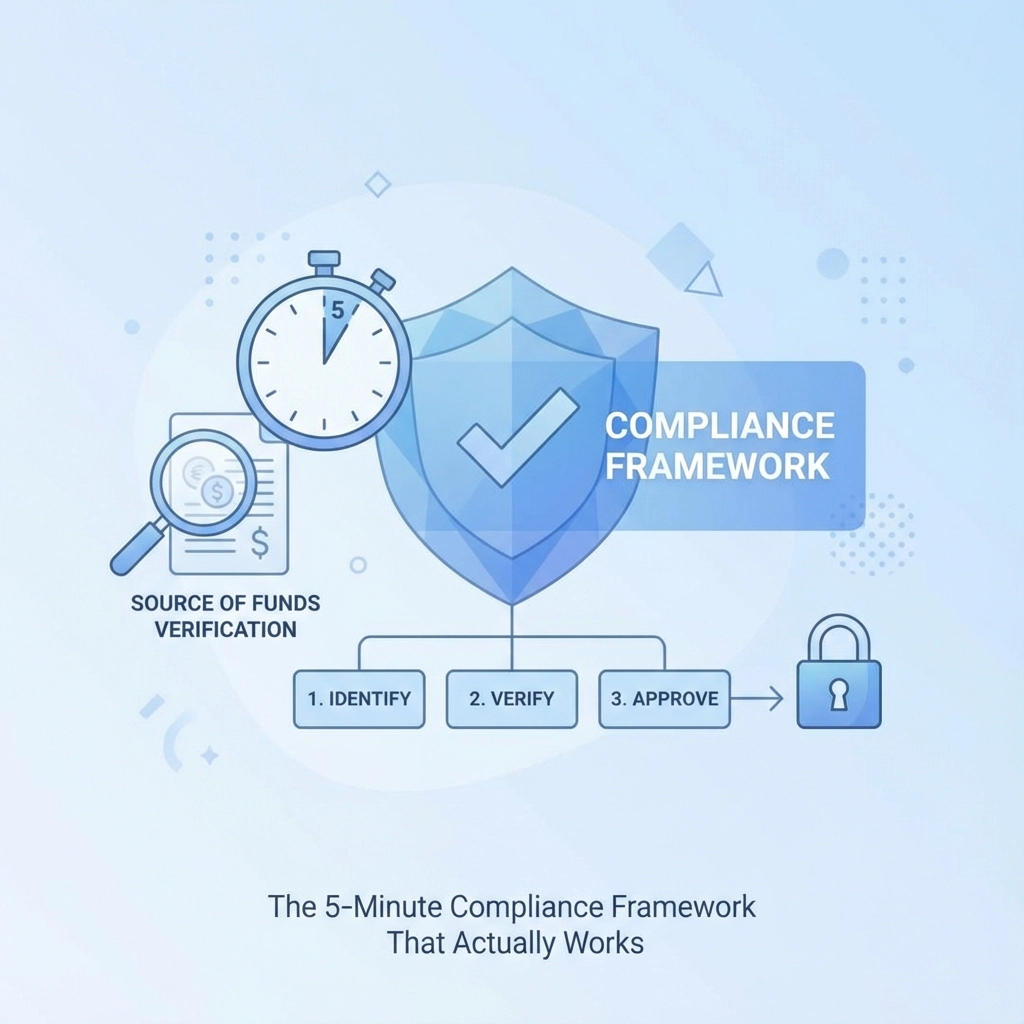

The 5-Minute Compliance Framework

Minute 1: Automated Risk Assessment

Begin every SoF verification with an automated risk score that evaluates client profile, transaction value, and funding complexity. This initial assessment determines the verification depth required and triggers the appropriate documentation pathway. High-value transactions above £500,000 or involving multiple funding sources automatically route to enhanced verification protocols.

Minute 2: Digital Document Collection

Deploy digital collection portals that guide clients through providing the exact documentation required for their risk profile. Rather than requesting generic "bank statements and proof of income," the system presents tailored document requests based on the funding source type and transaction characteristics.

Minute 3: Open Banking Verification

This represents the transformation point where traditional SoF verification becomes genuinely efficient. Open Banking connectivity allows direct verification of account balances, transaction histories, and fund movements without requiring manual document review. The system automatically verifies that declared funds match actual account balances and traces fund origins through connected banking relationships.

Minute 4: Cross-Reference and Validation

Automated systems cross-reference provided documentation against third-party databases, sanctions lists, and PEP registers while simultaneously validating document authenticity. This parallel processing approach eliminates the sequential verification steps that traditionally consumed the majority of verification time.

Minute 5: Compliance Documentation

Generate comprehensive verification reports that document all checks performed, evidence reviewed, and risk assessments completed. These reports automatically populate your case management system and create audit-ready documentation that exceeds SRA requirements.

How Open Banking Transforms SoF Verification

Open Banking represents the single most significant advancement in SoF verification technology since digital document management. By connecting directly to client banking systems through secure APIs, Open Banking eliminates the document authenticity concerns that plague traditional verification methods.

Real-Time Account Verification

Traditional bank statements can be outdated by weeks or manipulated before submission. Open Banking provides real-time account data that cannot be altered or misrepresented. The system automatically verifies current balances, recent transaction patterns, and fund availability without requiring client-provided documentation.

Comprehensive Transaction Tracing

Complex funding arrangements involving multiple accounts, transfers between family members, or business-to-personal transfers become instantly transparent through Open Banking connectivity. The system traces funds across connected accounts and identifies legitimate funding sources without extensive manual investigation.

Enhanced Due Diligence Automation

For transactions requiring enhanced due diligence, Open Banking provides 12-month transaction histories, regular income patterns, and spending behaviors that support comprehensive source of wealth assessments. This depth of insight traditionally required weeks of manual review and client correspondence.

ClearSignal's Source of Funds by Open Banking

ClearSignal's Source of Funds by Open Banking solution transforms the verification process from a time-intensive manual exercise into a streamlined digital experience that strengthens both compliance confidence and operational efficiency.

The platform integrates directly with your existing case management systems, creating a seamless verification workflow that requires no process disruption. When clients initiate SoF verification, they receive secure links to connect their bank accounts through Open Banking protocols, enabling instant verification of their declared funding sources.

Instant Verification Results

The system provides verification results within minutes rather than days, displaying clear confirmation of account balances, fund origins, and transaction legitimacy. For complex transactions involving multiple funding sources, the platform automatically maps fund flows and identifies any discrepancies requiring additional investigation.

Comprehensive Audit Trails

Every verification creates detailed audit documentation that exceeds regulatory requirements. The platform maintains permanent records of all account connections, data accessed, and verification results, providing bulletproof evidence of compliance due diligence if regulatory scrutiny occurs.

Risk-Based Processing

Advanced algorithms automatically adjust verification requirements based on transaction characteristics, client risk profiles, and regulatory guidance changes. The system ensures every verification meets current SRA expectations while avoiding unnecessary complexity for straightforward transactions.

Implementation Best Practices

Technology Integration Strategy

Successful SoF verification modernization requires seamless integration with existing workflows rather than wholesale process replacement. Begin with pilot implementations on high-value transactions where efficiency gains deliver immediate impact, then expand to standard conveyancing matters as team confidence builds.

Client Communication Excellence

Modern SoF verification enhances rather than complicates client relationships when positioned correctly. Frame Open Banking connectivity as a premium service that accelerates transaction completion while maintaining the highest security standards. Clients appreciate reduced documentation requirements and faster processing times.

Compliance Team Training

Invest in comprehensive training that covers both technical platform usage and regulatory interpretation. Team members need confidence in automated verification results and clear escalation procedures when manual review becomes necessary.

Measuring Success and ROI

Track three key performance indicators to quantify your SoF verification improvements: average verification completion time, client satisfaction scores, and compliance confidence ratings from fee earners. Successful implementations typically achieve 85% reduction in verification time, 40% improvement in client satisfaction, and 95% compliance confidence ratings.

The financial impact extends beyond operational efficiency to include reduced professional indemnity insurance premiums, improved client retention rates, and increased transaction volume capacity without proportional staffing increases.

Future-Proofing Your Verification Process

Regulatory requirements continue evolving, with enhanced sanctions screening and beneficial ownership verification becoming standard expectations. Building verification processes around flexible technology platforms ensures your firm adapts quickly to regulatory changes without operational disruption.

The investment in modern SoF verification technology pays dividends beyond immediate efficiency gains. Firms implementing comprehensive verification platforms position themselves as compliance leaders while building operational foundations that support sustainable growth in an increasingly complex regulatory environment.

Ready to transform your SoF verification from a compliance burden into a competitive advantage? Discover how ClearSignal's Source of Funds by Open Banking delivers the speed, accuracy, and confidence your clients expect from a modern legal practice.